st louis county mn sales tax

Saint Louis County Home Saint Louis County Land Explorer Parcel Tax Lookup Contact Information. 3 rows Saint Louis County MN Sales Tax Rate.

Duluth Ballot Asks For Higher Taxes To Restore Services Mpr News

S the structures were removed in 2019.

. Zoning is R-2 One Two Three and Four. Information on timber sales on state tax forfeited land. As far as all.

Louis County Auditor 218-726-2383 Ext2. This is the total of state and county sales tax rates. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Mail payment and Property Tax Statement coupon to. Previously 301 8th St. What is the sales tax rate in St Louis Park Minnesota.

Louis County is the largest county east of the Mississippi River. Additional methods of paying property taxes can be found at. Below are some tools to help you find property information that you may be looking for.

Monday - Friday 8 AM - 5 PM. Starting April 1 2015 St. The Minnesota state sales tax rate is currently.

Pay by E-Check for FREE online with Paymentus. 38 rows St Louis County Has No County-Level Sales Tax. The Minnesota Department of Revenue will administer these taxes.

Online auction continues October 13 through November 10 2022 at 1100 am. The St Louis County sales tax rate is. Other departments may be able to.

2022 Minnesota Sales Tax By County Minnesota has 231 cities. Your payment must be postmarked on or before the due date or penalties will apply. All contractors or sub-contractors must carry liability insurance and meet.

Louis County Board enacted. Recording fee 4600 Abstract. November 15th - 2nd Half Agricultural Property Taxes are due.

While many counties do levy a countywide. Louis County is known for its spectacular natural. This is the total of state county and city sales tax rates.

The most populous location in St. 41 South Central Avenue Clayton MO 63105. Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax.

The minimum combined 2022 sales tax rate for St Louis Park Minnesota is. If you need access to a database of all Minnesota local sales tax rates visit the sales tax data page. Located in the arrowhead region of Northeastern Minnesota St.

The right to withdraw any parcel from sale is hereby reserved by St. Parcel is subject to Public Water visit the MN DNR website for more information. See all other payment options below for associated.

The average cumulative sales tax rate between all of them is 773. A full list of these can be found below. The 2018 United States Supreme Court decision in.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands. Louis County Tax-Forfeited Land Sale Auctions.

A vacant - 56 x 120 corner lot in the city of Virginia. Louis County Minnesota is Duluth. The current total local sales tax rate in Saint.

80 Acres Of Land For Sale In Hermantown Minnesota Landsearch

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

St Louis County Land Explorer Arrowhead Bowhunters Alliance

St Louis County Minnesota Public Records Directory

Saint Louis County Mn Land For Sale 645 Listings Landwatch

Minnesota Sales Tax Rates By City County 2022

Land For Sale Property For Sale In Saint Louis County Minnesota Land Com

Tax Forfeited Land Sale Includes 18 Houses Former Clover Valley School Site

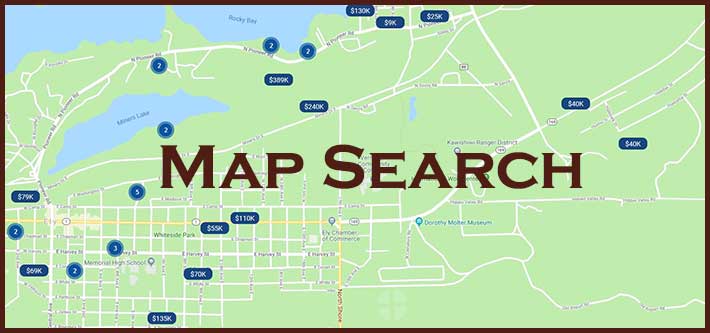

Ely Mn Real Estate Sales From Your Full Service Realtor Wildwoods Land Company

Saint Louis County Mn Real Estate Saint Louis County Mn Homes For Sale Zillow

Cost Of Living In Clinton Township St Louis County Minnesota Taxes And Housing Costs

St Louis County Minnesota Departments A Z Public Health Human Services Public Health Covid 19 Learn More About Covid 19