b&o tax seattle

Business occupation tax classifications. Sign in if you already have an account.

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

The square footage BO tax is based on rentable square feet.

. City of Seattle income tax apportionment provisions Seattles BO tax is generally imposed on all persons engaging in business activity within the city. Extracting Extracting for Hire00484. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am.

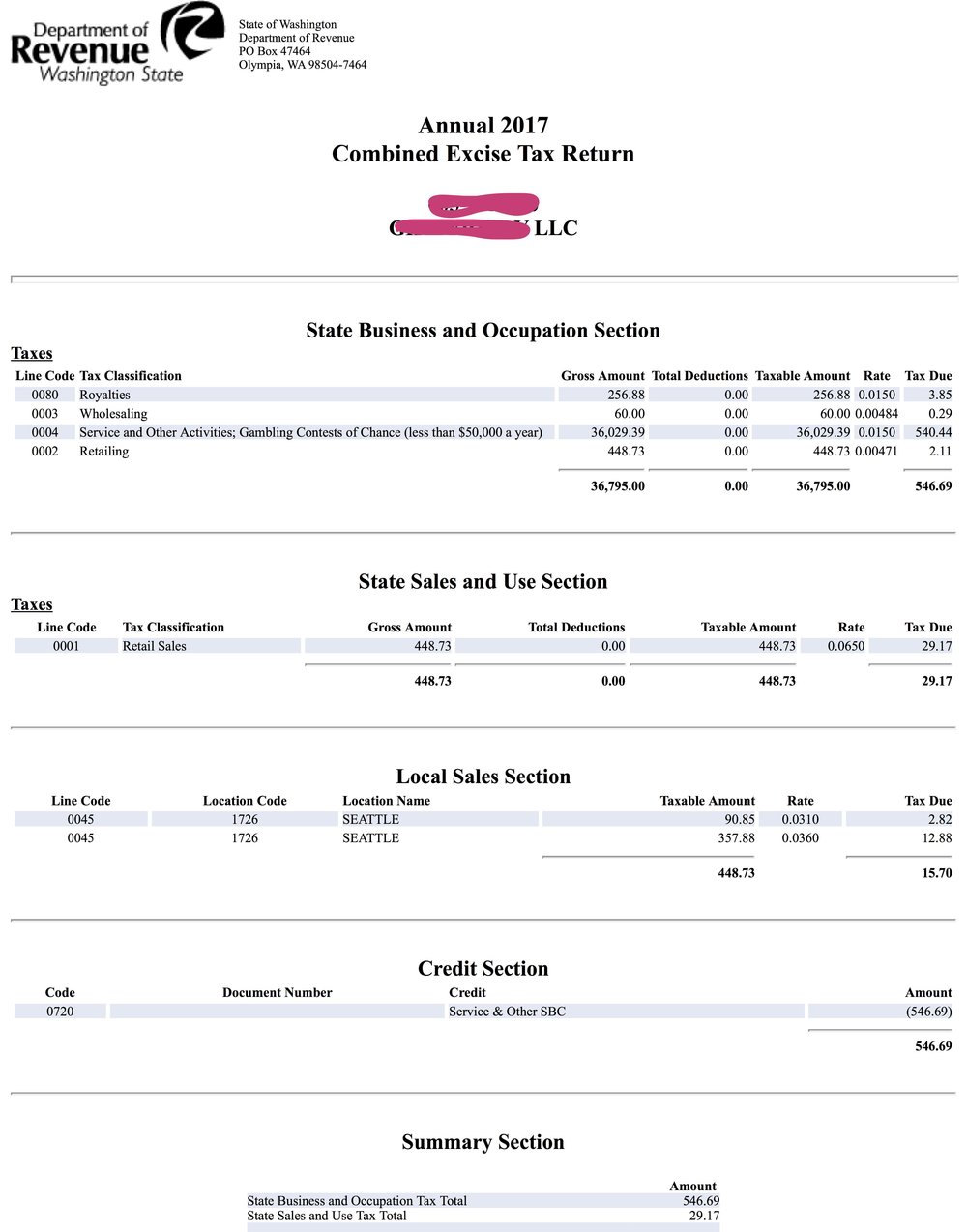

Service other activities015. Specialized BO tax classifications. The state BO tax is a gross receipts tax.

Need to get a city business license or pay local business taxes like BO. You pay the tax if your annual taxable gross revenue is 100000 or more. Teletype TTY users may use the Washington Relay service by calling 711.

The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW. Enter the taxable sales for litter tax under Taxable Amount. If your business is a professional services firm like a law or accounting firm and you are filing a local tax return for 2019 the tax rate you will pay is 000427 or 427.

3 In 2006 KMS successfully defeated an effort by Seattle to impose a BO tax on KMS based on all commissions received in the KMS Seattle office regardless of where the registered representative generating the. Think the Apple Cup but with lots more money at stake. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

Manual forms can be completed and mailed to the address provided on the back of the form. Kenmores BO tax applies to heavy manufacturing only. Multiply the taxable amount by the rate shown and enter the amount under Tax Due.

Open Monday through Friday 8 am. PO Box 94728 Seattle WA 98124-4728 Phone. Called the Business Occupation Tax the BO is loathed with the intensity usually reserved for your college football teams archrival.

If you have questions regarding the Washington BO tax or other tax reform matters please contact any of the following Deloitte Tax professionals. Robert Wood Tax manager Deloitte Tax LLP Seattle 1 206 716 7076. Washington unlike many other states does not have an income tax.

Business occupation tax classifications Print. However you may be entitled to the. 600 4th Ave 3rd Floor Seattle WA 98104 Mailing Address.

Simple fast and time-saving. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Have a local BO tax.

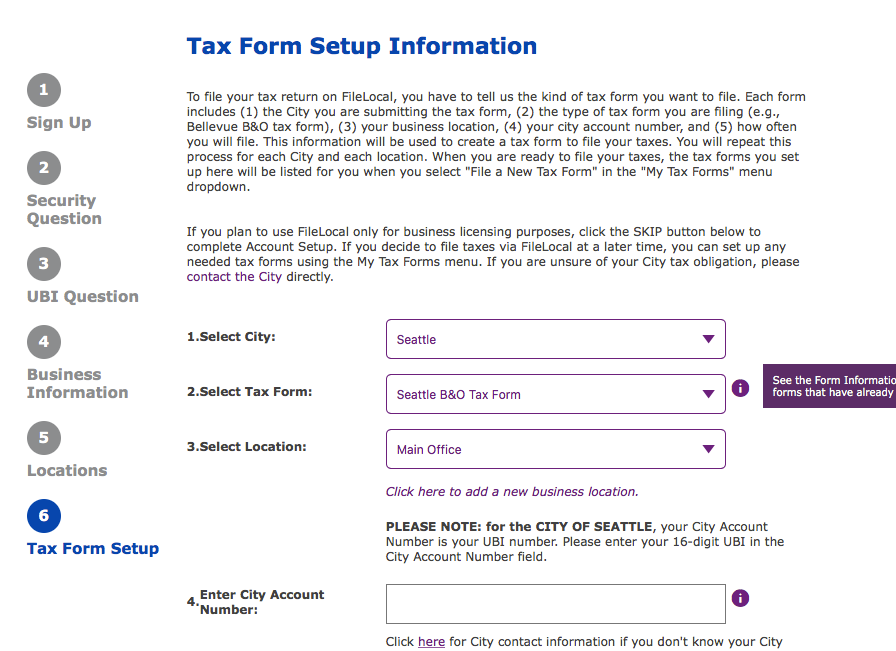

FileLocal is the online tax filing portal for the City of Seattle. Box 34214 Seattle WA 98124-4214. License and Tax Reminders resources inspiration and more.

Our public counters on the 4th floor of the Seattle Municipal Tower 700 Fifth Ave are now open by appointment only Tuesdays and Wednesdays 830 am-4 pm. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered. Washingtons BO tax is calculated on the gross income from activities.

If you do business in Seattle you must. Returns are not deemed filed until both tax filing and. The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other floor space.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. Business Occupation Taxes. License and tax administration 206 684-8484 taxseattlegov.

Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. Scott Schiefelbein Tax senior manager WNT Multistate Deloitte Tax LLP Portland 1 503 727 5382. The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities.

If youre a first-time user create a business account below. This table below summarizes Seattle business license tax rates and classifications. For tax assistance or to request this document in an alternate format please call 1-800-647-7706.

Have a Seattle business license see the due dates for that here file a business license tax return. Manufacturing Processing for Hire Extracting Printing Publishing Wholesaling and. How to Become Self-Employed in Seattle.

This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. This is the same portal many taxpayers currently use to file and pay a variety of other Seattle business taxes including BO Commercial Parking Admissions etc. Although there are exemptions every person firm association or corporation doing business in the city is subject to the BO tax.

BO 11-7-17 Litter Tax Line 11 1. The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories. Nobody likes taxes but people really really hate the levy Washington imposes on businesses.

On Amazon and in local stores. A Guidebook Companion and Reference. Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax.

Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. FileLocal offers businesses a one stop place to meet their license and tax filing needs. If your business is a retail store and you are filing a local tax return for 2017 the tax rate you will pay is 000219 or 219.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes. It is measured on the value of products gross proceeds of sale or gross income of the business.

To 5 pm Monday-Friday excluding City holidays. The tax amount is based on the value of the manufactured products or by-products. Contact the city directly for specific information or other business licenses or taxes that may apply.

If you need to file a 2021 annual tax return and have revenue that is below the 100000 threshold you can use this tax form. The BO is a tax on gross receipts.

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

B Amp O Tax Return City Of Bellevue

Business License Fees And B O Taxes Going Up

For Retail Combo Businesses How To Make Your Annual Report To The City Of Seattle For B O Taxes Seattle Business Apothecary Resource Center For Self Employed Women

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

City Of Seattle License Fill Online Printable Fillable Blank Pdffiller

The Infamous B O Tax Seattle Business Magazine

City Of Seattle B O Tax Deferment Information Essential Southeast Seatte

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

The Infamous B O Tax Seattle Business Magazine

Why Our B O Tax Is Unfair R Seattlewa

State Supreme Court Upholds B O Tax On Large Banks In Washington Mynorthwest Com

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Business And Occupation Tax Credit Commute Seattle

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

State Carbon Tax Initiative Pencils Out Nicely For Boeing The Seattle Times

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms